Navigating the New UK Non-Dom Tax Rules: Essential Insights from 6 April 2025

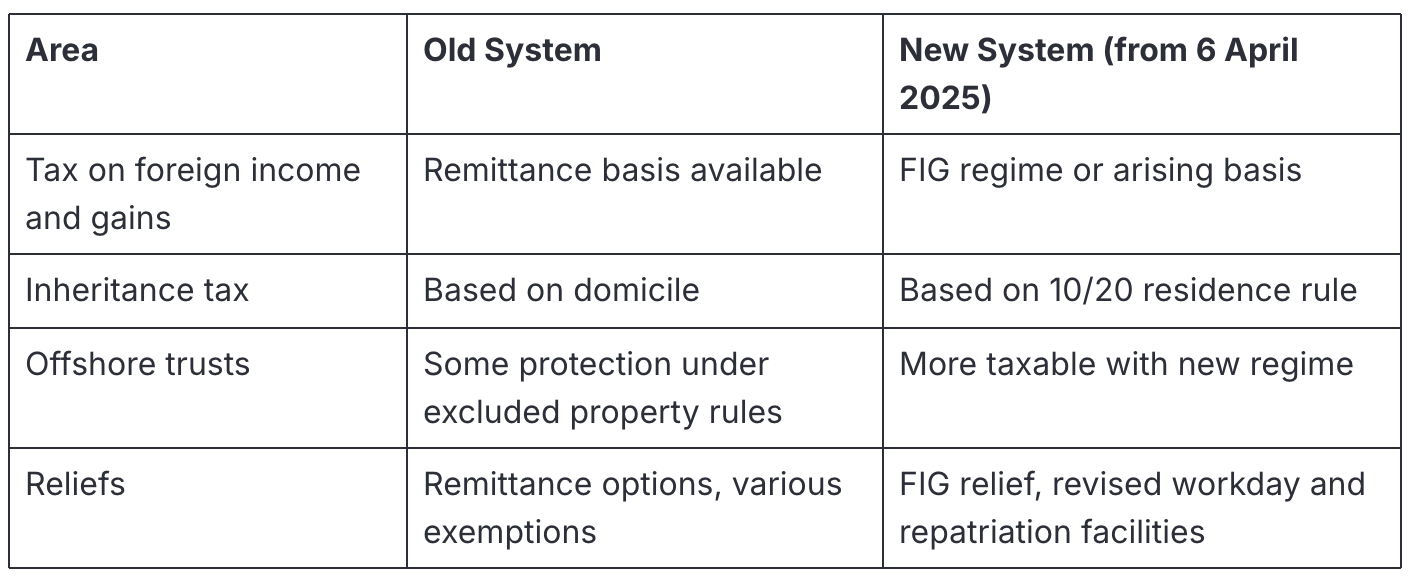

As UK tax advisors, we are closely monitoring the most significant reforms to the UK’s non-domiciled (“non‑dom”) tax rules in decades. From 6 April 2025, the government is replacing the longstanding remittance basis system with a residence-based taxation framework, fundamentally changing how foreign income, gains, trusts, and inheritance tax planning apply to internationally mobile individuals.

This briefing outlines the key changes, practical implications, and planning considerations for non-doms and their advisors.

1. Goodbye Remittance Basis - A Residence-Based System Takes Its Place

Under the old regime, UK residents who were non-domiciled could choose to be taxed on the remittance basis, meaning foreign income and gains were only taxed if brought (“remitted”) into the UK. This system will no longer apply for tax years starting on or after 6 April 2025.

Instead, the UK has introduced a 4-year Foreign Income and Gains (FIG) regime for certain new residents:

New arrivals who have not been UK tax resident for the 10 previous years can qualify for 100 % relief on foreign income and gains for their first four years of UK residence.

During this period, foreign income and gains can be brought to the UK without additional tax charges - a practical alternative to the remittance basis.

However, individuals who don’t qualify for FIG relief (e.g., long-term UK residents before the change) will be taxed on worldwide income and gains as they arise, much like UK domiciles.

2. Inheritance Tax: From Domicile to Residence

One of the biggest structural shifts is in Inheritance Tax (IHT). Previously, IHT exposure on foreign assets was largely tied to domicile status; now it is based on UK residency history:

Individuals who have been resident in the UK for 10 of the last 20 tax years will be treated as a “long-term resident” for IHT purposes.

Long-term residents will be subject to UK IHT on worldwide assets, not just UK-situs assets.

When they leave the UK, they may remain within the IHT net for a period - from three to ten years - depending on how long they were resident.

This residency test replaces the old domicile-based rules.

3. Trusts and Offshore Structures

The changes also significantly affect offshore trusts:

Protection from UK tax on income and gains arising within settlor-interested trusts will no longer be available for those who don’t qualify for the FIG regime.

Trust distributions and underlying income may be taxable on an arising basis to UK resident settlors.

Special transitional rules apply for trusts established before 30 October 2024, but even here new IHT exposure and periodic charges can arise.

For many clients with legacy trust structures, this has created an urgency to revisit planning before 6 April 2025.

4. Overseas Workday Relief and Other Technical Adjustments

Certain existing benefits like Overseas Workday Relief (OWR) have been retained but modified:

OWR is now aligned with the four-year FIG regime and available where appropriate, subject to limits.

Some previous reliefs on employment overseas earnings have been narrowed or removed, so more items of income are fully taxable in the UK.

These smaller technical changes can still have meaningful effects on tax liabilities for cross-border workers.

5. Transitional and Practical Considerations

The government introduced temporary transitional provisions to ease the shift from the remittance basis. For example:

Certain foreign income and gains that arose before the regime change may benefit from reliefs like the Temporary Repatriation Facility (TRF) at reduced rates for a limited period.

Capital gains on foreign assets can be rebased to 5 April 2017 values for some taxpayers, helping manage the tax cost of disposals.

Planning ahead is crucial: tax residence status, the timing of arrivals or departures, and the structuring of foreign investments all affect whether you can maximise reliefs or minimise UK exposure.

6. What This Means for You (Quick Summary)

Final Thoughts

The abolition of the traditional non-dom regime marks a fundamental shift in how internationally mobile individuals are taxed in the UK. Whether you’re planning to move to the UK, already resident, or restructuring offshore assets, these changes demand careful attention.

If you have foreign income, trusts or complex estate planning structures, consider seeking bespoke tax advice to navigate this new landscape and align your affairs with the updated UK tax framework.

The upcoming changes to the UK non-dom tax rules are significant. They affect how you manage your tax obligations. Understanding these changes is crucial to staying compliant.

Contact Us | Expert Tax Advisors in Surrey

Get in touch:

📧 hello@surreyhillstax.co.uk

📞 01483 970 410